Nps National Pension System Scheme

- Fri Aug 02 18:30:00 UTC 2024

- In Mentoring and Guidance by Aparna Bose

WHAT IS NPS?

National Pension System or Scheme (NPS) India is a voluntary and long-term investment plan for retirement under the purview of the Pension Fund Regulatory and Development Authority (PFRDA) and the Central Government.

The National Pension System (NPS) is a pension system open to all citizens of India. The NPS invests the contributions of its subscribers into various market-linked instruments such as equities and debts and the final pension amount depends on the performance of these investments.

An Indian citizen in the age group of 18-70 can open an NPS account. NPS is administered and regulated by the Pension Fund Regulatory Authority of India (PFRDA). The superannuation age in NPS is 60, however, individuals can continue until the age of 75

Partial withdrawals of up to 25% of an individual’s contributions can be made from the NPS after three years of account opening but for specific purposes like home buying, children’s education, or serious illness. Partial withdrawal is allowed for three times in the entire life cycle. Further, there is no lock-in period to execute the second and the third partial withdrawal, however, the same applies only to the incremental investment.

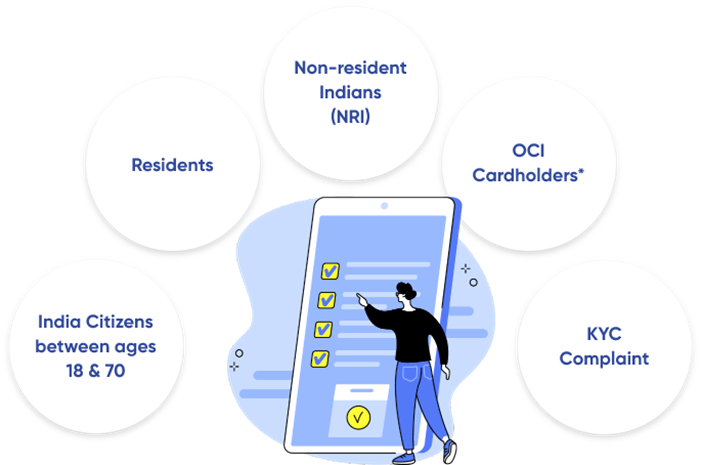

WHO IS ELIGIBLE FOR NPS?

Any individual citizen of India (both resident and Non-resident) in the age group of 18-70 years (as on the date of submission of NPS application)

The National Pension Scheme (NPS) is a social security initiative by the Central Government. This pension programme is open to employees from the public, private and even the unorganised sectors, except those from the armed forces.

The NPS is a good scheme for anyone who wants to plan for their retirement early on and has a low-risk appetite. A regular pension (income) in your retirement years will no doubt be a boon, especially for those individuals who retire from private-sector jobs

A systematic investment like this can make a massive difference in your life post-retirement. In fact, salaried people who want to make the most of the 80C deductions can also consider this scheme.

WHO IS NOT ELIGIBLE FOR NPS?

However, Hindu Undivided Families and Persons of Indian Origin are not eligible for subscribing to NPS . NPS is an individual pension account and cannot be opened on behalf of a third person.

The scheme encourages people to invest in a pension account at regular intervals during the course of their employment. After retirement, the subscribers can take out a certain percentage of the corpus. As an NPS account holder, you will receive the remaining amount as a monthly pension post your retirement.

ELIGIBILITY CRITERIA-PIO card holders are not eligible to open NPS accounts(image courtesy:CAMS site)

HOW TO OPEN AN ACCOUNT?

REGISTRATION AT POP

- Step 1: Locate your nearest PoP.

- Step 2: Visit the PoP and fill up the application form.

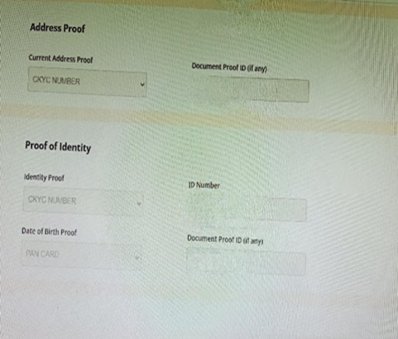

- Step 3: Fulfil the KYC norms by submitting all the relevant documents.

- Step 4: You will have to pay a minimum of Rs 500 for a Tier I account.

- Step 5: Submit the application form.

Procure your Permanent Retirement Account Number (PRAN) application form

"As a Subscriber between the age brackets of 18 to 70 years of age, you can procure your PRAN application form from any of the Point of Presence - Service Providers (POP-SP) you wish to register with. You can also procure the PRAN application form from our website by clicking here."

"You have to ensure that your PRAN application form is filled up i.e. photograph, signature, mandatory details, scheme preference details etc and also submit KYC documentation with respect to proof of identity and proof of address. For detailed information on NPS, please refer to the offer document prescribed by the Pension Fund Regulatory and Development Authority (PFRDA)."

Submit PRAN application form to your nearest Point Of Presence - Service Provider (POP-SP)

You can go to your nearest POP-SP and submit the PRAN application along with the KYC documents. PRAN card will be sent to your correspondence address by CRA.

Track your PRAN application

At the time of submission of the PRAN application, POP-SP shall give you a receipt number. You can track the status of your PRAN application by entering the receipt number in the following link: https://cra-nsdl.com/CRA/pranCardStatusInput.

Submit your first Contribution Slip

You are required to make your first contribution (minimum of Rs 500) at the time of applying for registration to any POP-SP. For this, you will have to submit NCIS (Instruction Slip) mentioning the details of the payment made towards your PRAN account.

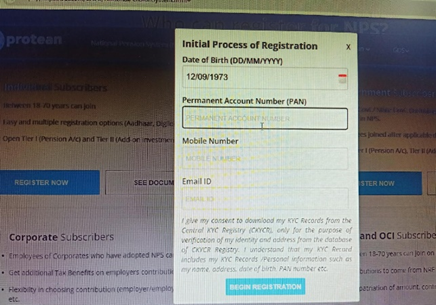

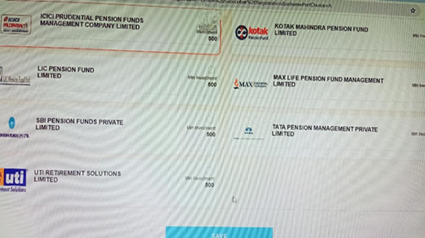

ONLINE REGISTRATION

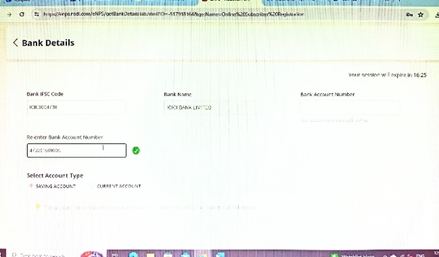

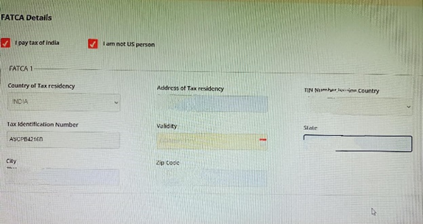

To open a National Pension System (NPS) account online, you must have an internet banking account with one of the 17 banks registered with the National Securities Depository Limited (NSDL). If your PAN (Permanent Account Number) is linked to your bank account, you can log in to the eNPS portal to start the registration process. Your bank will handle the other Know Your Customer (KYC) details on your behalf.

Previously, it was possible to open an NPS account using your Aadhaar number, but this option has been discontinued. Now, a PAN number is mandatory for registration.

Before starting the registration, ensure you have the following details ready:

- PAN number and Net banking details

- Scanned passport-size photograph (4 to 12 KB, JPG format)

- Scanned image of your signature (4 to 12 KB, JPG format)

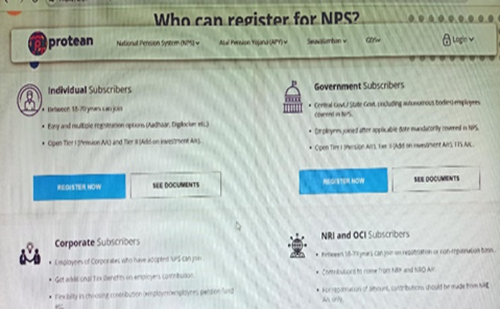

- Here are the steps for opening an NPS account online via the eNPS website ( PROTEAN , previously NSDL):

1. Visit the Website:

- Go to the Protean (formerly NSDL) eNPS website:

https://enps.nsdl.com/eNPS/OnlineSubscriberRegistration.html?appType=main

2. Select the Desired Option:

- On the homepage, two options will be displayed: "REGISTER NOW" and "CONTRIBUTE NOW."

- Choose "REGISTER NOW" to create a new NPS account.

3. Registration Process:

- The next page will display various categories and the documents required for registration.

- Follow the instructions based on your selected category and provide the necessary information.

4. Document Linking:

During registration, your mobile number, Aadhaar, and Permanent Account Number (PAN) will be linked with the NPS account.

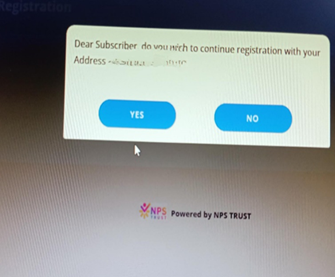

On receiving your PAN number, the site will check your KYC. If they find it valid and acceptable, the rest of the process will be mostly hassle-free.

The subscriber has to fill in all mandatory fields and upload his/her photograph & signature.

If eNPS site rejects your KYC you would be asked to get a Re-KYC/ KYC validation done before proceeding for registration.

An NPS applicant’s KYC verification is done by the empanelled Banks (name and address should match with bank record) which is selected by applicant during the registration process.(not required in case of Aadhaar).

If registering through Aadhaar Number:

- If the individual provides Aadhaar number as the starting input, all his/her details like name, address etc. are captured automatically from the Aadhaar data base.

- The subscriber has to fill in all mandatory fields (such as personal details, bank details, nomination details and scheme details) and upload his/her photograph & signature. Subscriber photograph is picked up from the Aadhaar database. If subscriber desires, he/she can change the photograph.

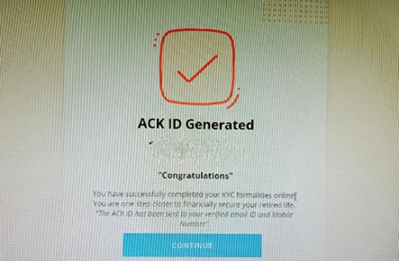

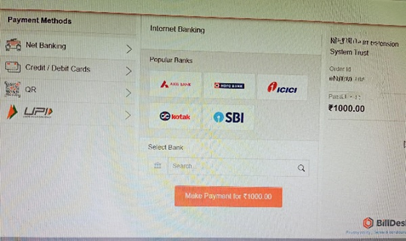

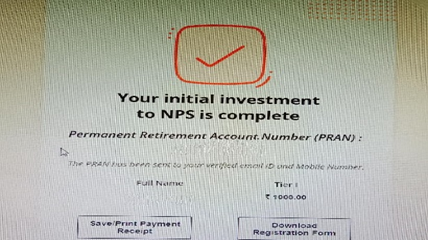

- After completion of these steps, the subscriber is taken to the payment gateway screen, for payment of initial contribution and thereafter, the PRAN is generated.

- The subscriber has to fill in all mandatory fields and upload his/her photograph & signature.

- After completion of these steps, the subscriber is taken to the payment gateway screen, for payment of initial contribution and thereafter, the PRAN is generated.

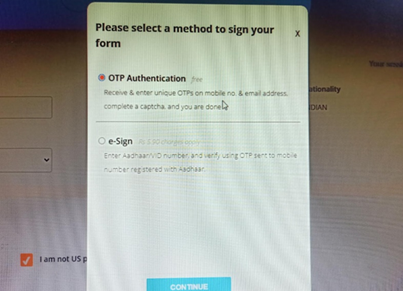

Subscriber will be provided option to do e-sign (through Aadhaar number) for the registration activity. If subscriber uses the e-sign option, he/she is not required to send the physical form to CRA. If subscriber has not done e-sign, subscriber should print the auto-populated form, affix photo, sign it and send it to the CRA within 90 days of generation of PRAN.

If subscriber has not done e-sign, subscriber should print the auto-populated form, affix photo, sign it and send it to the CRA within 90 days of generation of PRAN. The form should be sent within 90 days from the date of allotment of PRAN to CRA at the following address failing which, the PRAN will be ‘frozen’ temporarily.

P.S. FOR NRIs - In addition to the common steps for registering in eNPS, NRI subscriber should:

- Select the Bank Account Status i.e., Non-Repatriable account or Repatriable account.

- Provide the NRE/NRO bank account details and upload scanned copy of passport.

- Select the preferred address for communication i.e., Overseas Address or Permanent Address (communication at overseas address would entail extra charges).

- NRI & OCI SUBSCRIBERS- Between 18-70 years can join on repatriation or non-repatriation basis. Contributions to come from NRE and NRO A/c. For repatriation of amount, contributions should be made from NRE A/c only.

5. Verification:

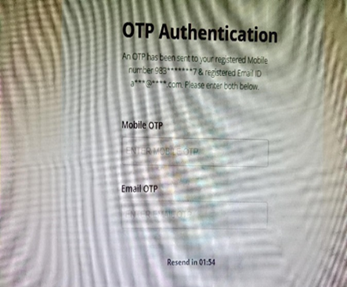

- An OTP (One-Time Password) will be sent to your registered mobile number for verification.

6. Receive PRAN:

- After completing the registration, you will receive a Permanent Retirement Account Number (PRAN), a 12-digit unique identifier.

- PRAN can be used to log in to your NPS account.

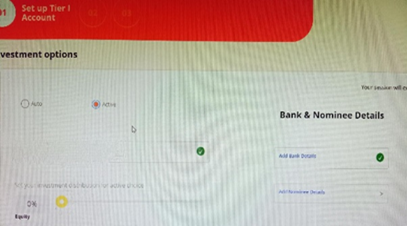

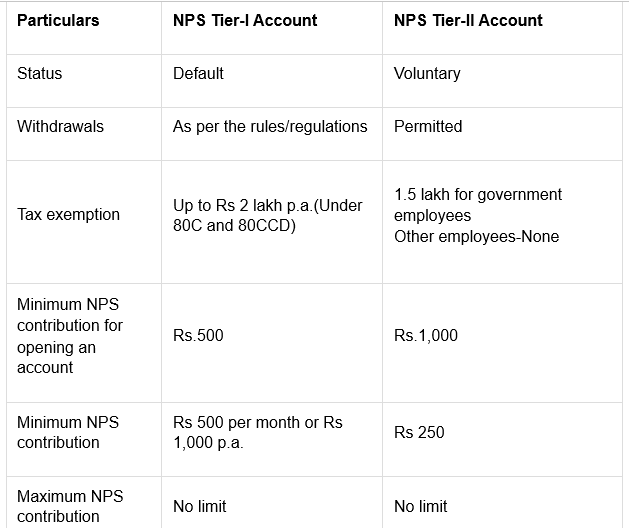

7. Tier II Account (Optional):

- If you wish to open a Tier II account, you may select the option during registration, or you can choose to contribute only to the Tier I account.

8. Minimum Contribution:

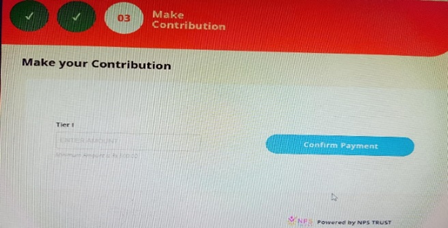

- Tier I subscribers are required to make an initial contribution of at least Rs 500 at the time of registration.

- After the initial contribution, the minimum amount for subsequent contributions is Rs 500.

- Tier I subscribers must contribute at least Rs 1,000 during the financial year.

- There is no maximum limit on contributions.

9. Withdrawal Restrictions:

- Withdrawals from the NPS account are not allowed until the subscriber reaches the age of 60 years.

The entire process is user-friendly and straightforward.

Subscriber has to visit the protean( previously NSDL) site https://enps.nsdl.com/eNPS/NationalPensionSystem.html# for registration of or contribution to the nps account by selecting NPS from the dashboard. The two options will flash as soon as the page opens- REGISTER NOW AND CONTRIBUTE NOW.

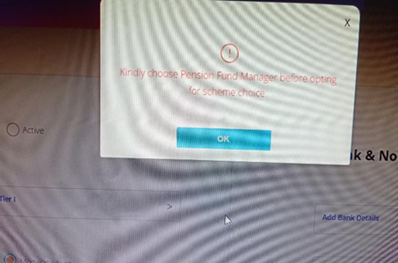

Once the subscriber clicks on the register now the next page opens and various categories along with the documents required for registration is displayed. One may proceed accordingly.

Your mobile number, Aadhaar, and Permanent Account Number (PAN) gets linked with the NPS account. To complete the validation, an OTP will be sent to your registered mobile number.

Upon completion of registration, you (the subscriber) will receive a PRAN (Permanent Retirement Account Number, is a 12-digit unique identifier) , which can be used to log in to your NPS account.

If you wish to open a tier II account as well then you may select the option or ignore if you wish to limit your contribution to Tier I only. Tier I subscribers of the NPS scheme are required to make a minimum initial contribution of Rs 500 at the time of registration after which subscribers can contribute a minimum of Rs 500 per contribution.

Tier I subscribers are required to contribute at least Rs 1,000 during the financial year. However, the maximum contribution is unlimited. Withdrawals are not allowed until the subscriber attains the age of 60 years.

FEATURES OF AN NPS ACCOUNT

The features of an NPS account are listed below:

At maturity, 40% of the NPS corpus is tax-free, while the remaining 60% is subject to taxes.

The amount used to buy an annuity is tax-free.

Your corpus will not attract any tax if you withdraw 40% and invest the remaining 60% in an annuity.

You must use at least 40% of the corpus to buy an annuity.

Lump sum withdrawals are subject to tax.

The total tax exemption in NPS under Section 80(C) has been increased from Rs.1.5 lakh to Rs.2 lakh per year.

The annuity pension will be taxed according to the account holder's tax bracket.

FAQ

1. Can Subscriber avail loan against his/her NPS account?

No, NPS Subscriber can't avail loan against his/her NPS account. Though Subscriber may opt for Partial Withdrawal subject to certain conditions.

2. Can Subscriber opt for Withdrawal during his/her service period?

Yes, Partial Withdrawal facility is available for NPS Subscribers whereby Subscriber can opt for Withdrawal of certain amount out of his own contribution subject to certain conditions.

3. What are the conditions for availing Partial Withdrawal?

Following are the conditions for availing Partial Withdrawal:

The Subscriber shall have been in the NPS at least for the period of three years from the date of his or her Joining (in case of Govt. & Corporate Subscribers)/date of PRAN generation (in case of ’All Citizens’ sector).

The Subscriber shall be allowed to withdraw only a maximum of three times during the entire tenure of subscription.

The Subscriber can opt for withdrawal not exceeding 25% of contributions made by him/her.

4. What are the reasons for availing Partial Withdrawal?

Withdrawal is allowed only against the specified reasons such as:

- Higher education of children

- Marriage of children

- For the purchase/construction of residential house.

- To meet medical and incidental expenses arising out of the disability or incapacitation suffered by the Subscriber.

- For Skill development/re-skilling or any other self-development activities.

- For Establishment of own venture or any start-up (Only for ’All Citizens’ Sector Subscribers).

- For more detailed description of Partial Withdrawal option under NPS, please refer Regulation 8 of PFRDA (Exits & Withdrawals under NPS) Regulations 2015 and amendments thereto.

5. How can the Partial Withdrawal be processed? What is the process for Partial Withdrawal?

As per PFRDA guidelines, the Subscribers will have an option to avail Partial Withdrawal based on self-declaration and no supporting documents (w.r.t. stated withdrawal reason) are required to be submitted by the Subscriber for availing Partial Withdrawal.

The Subscriber will follow below steps:

Subscriber will initiate online Partial Withdrawal request in CRA system (www.cra-nsdl.com) by logging with PRAN as User ID & Password.

Subscriber will select “Tier I Partial Withdrawal” option under “Continuation & Withdrawal” Menu. The eligible amount for Partial Withdrawal will be displayed to the Subscriber. Subscriber will provide the required percentage and reason for partial withdrawal.

During request initiation, the Bank Account of the Subscriber will be verified through online Bank Account Verification. The Bank of the Subscriber should be empanelled for Online Bank Account Verification. Only if Bank Account verification is successful, then the Subscriber will be allowed to initiate Partial Withdrawal request.

Subscriber will accept the self-declaration for reason for Partial Withdrawal.

Subscriber is required to submit the request using OTP Authentication / eSign.

In case of OTP Authentication, two separate One Time Password (OTP) will be sent on

Mobile Number and email ID registered in CRA. In case of eSign, the OTP will be sent on Mobile Number registered with Aadhaar.

On successful submission, request will get executed in CRA. No supporting documents are required to be submitted to the associated POP. Also, request is not required to be verified by the POP.

Partial Withdrawal amount will be transferred to Subscriber’s Bank Account within stipulated timeline.

6. What are the pre-requisites for Online Partial Withdrawal?

Subscriber should have fulfilled the conditions for Partial Withdrawal as per PFRDA guidelines as mentioned above.

Active Bank Account details of the Subscriber are updated in his/her NPS account. Bank of the Subscriber should be empanelled for Online Bank Account Verification.

Subscriber is required to submit the request using OTP Authentication / eSign. Hence, valid Mobile Number and email ID of the Subscriber should be registered in CRA to receive OTP as part of OTP Authentication. Else, the Mobile Number registered with Aadhaar should be valid to receive OTP as part of eSign and also the name in Aadhar & CRA record should match.

7. What process to be followed if OTP Authentication / eSign is not possible or Subscriber is not able to initiate online Partial Withdrawal Request?

If OTP Authentication / eSign is not possible or the Subscriber is not able to initiate online Partial Withdrawal request in CRA system for any reason, then the Subscriber is required to submit physical Partial Withdrawal Form (with self-declaration) to the associated POP.

Subscriber will accept self-declaration for reason of withdrawal and submit copy of Bank Proof for Bank Account registered in CRA.

The POP will initiate and authorize the Partial Withdrawal request in the CRA system with Maker-Checker User ID. No supporting documents (w.r.t. stated withdrawal reason) are required to be submitted by the Subscriber.

Partial Withdrawal Form (with self-declaration) is available under "Forms" section, which is available under respective sector on this website.

The Standard Operating Procedure (SOP) on partial withdrawal request processing is available under “Point of Presence (POP) Corner” section, which is available under respective sector on this website.

8. Can Subscriber do Partial Withdrawal for Covid?

Yes, Partial Withdrawal is permitted for treatment of specified illnesses which includes Covid as well.

9. Are any supporting documents required to be submitted for Partial Withdrawal?

No supporting documents (w.r.t. stated withdrawal reason) are required to be submitted by the Subscriber for availing Partial Withdrawal. The Subscriber is required to accept the self-declaration for reason for Partial Withdrawal.

10.What Tax benefits are available in case of Partial Withdrawal?

The amount received by employee under the NPS is tax exempted.

11.What is the Process to be followed if Online Bank Account Verification (Penny drop) fails?

Due to Bank Account related rejection - Subscriber is required to update the correct (new) Bank Account details in his/her NPS account. Once the Bank details are updated in CRA, then Subscriber can initiate new request in CRA.

For updation of Bank details in CRA records, the Subscriber has an option to update the same online in CRA system (www.cra-nsdl.com) or submit Form S2 – Subscriber details change Form to associated POP. The Form S2 is available under "Forms" section, which is available under respective sector on CRA website (www.npscra.nsdl.co.in).

Due to name mismatch – If failure in online Bank Account Verification (Penny drop) is due to name mismatch and if Subscriber’s name registered in CRA is correct, then the Subscriber is required to submit the physical Partial Withdrawal Form to POP alongwith Bank Proof. On receipt of physical Partial Withdrawal Form, POP will initiate & authorize Partial Withdrawal Request in CRA System.

12. Can I make a contribution to my NPS account before I receive my PRAN card?

Yes, you can contribute to your NPS account even before you receive your PRAN card. Once your PRAN is generated, contributions can be made irrespective of whether the physical copy of the PRAN card is received or not.

13. How much time does it take for contribution to reflect in my NPS account?

Your contribution reflects in NPS account within T+2 working days (T = date of successful transaction).

14. The payment got deducted from my bank account but my NPS account does not show the contribution. What can I do?

In case the contribution doesn’t reflect in your account within T+2 working days, you can register your grievance by logging into your CRA portal. You can also submit your complaint at any PoP-SP.

Earlier, the NPS scheme covered only Central Government employees. Central Government employees joining on or after 01-01- 2004 are mandatorily covered under the NPS. Now, however, the PFRDA has made it open to all Indian citizens on a voluntary basis.

The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement. The scheme is portable across jobs and locations, with tax benefits under Section 80C and Section 80CCD.

15.What happens to 40 annuity in NPS after death?

- If you have purchased an annuity scheme with ROP (Return of purchase price), then the 40% corpus is returned to the nominee after the event of death.

16. How long does an annuity last for NPS?

OR

What are the different types of annuity plans?

Annuity/ pension payable for life at a uniform rate.

Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

Annuity for life with return of purchase price on death of the annuitant.

Annuity payable for life increasing at a simple rate of 3% p.a.

Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her lifetime on death of annuitant. The purchase price will be returned on the death of last survivor.

17. What is Systematic Lumpsum Withdrawal in NPS?

Systematic Lumpsum Withdrawal is a retirement withdrawal option that allows NPS subscribers to receive a portion of their accumulated Lumpsum corpus at regular intervals at the time of retirement /normal exit.

18. When can I opt for Systematic Lumpsum Withdrawal?

You can opt for Systematic Lumpsum Withdrawal at the time of your retirement during Superannuation. Exit due to Death of NPS Subscriber and Premature Exit requests will not have the option of SLW.

19. Is SLW option available for Annuity Corpus?

Subscriber can opt for SLW only for lumpsum corpus and not for Annuity corpus.

20. How much can I withdraw as a lump sum through SLW option?

The same depends upon the corpus. Subscriber can withdrawal 60% corpus earmarked as lumpsum as per the desired frequency at yearly, half-yearly, quarterly, or monthly withdrawals. The remaining 40% must be used to purchase an annuity for a regular pension.

21. Can I opt for Scheme Preference / PFM Change during SLW tenure.

Yes, can opt for Scheme Preference / PFM Change. However, it will be applicable only for the lump sum portion. Annuity portion, if not already withdrawn will remain as per existing scheme choice only and no changes will be applicable in the corpus therein.

22. Can I select the frequency of lump sum withdrawals?

Yes, you can choose the frequency of lump sum withdrawals. You can opt for yearly, half- yearly, quarterly, or monthly withdrawals.

23. Is the Systematic Lumpsum Withdrawal option available to all NPS subscribers?

Yes, this option is available to all NPS subscribers, including government employees and private sector individuals in Tier1 account as well as in Tier II account.

24. Can I change the lump sum withdrawal frequency after selecting it?

Yes, you can change the frequency of lump sum withdrawals, during the tenure of your SLW.

25. Can I change my bank account during the tenure of SLW?

Yes, you can change your bank account. The revised bank account changes shall be subject to bank account verification. Upon successful verification, revised bank account shall be updated in your PRAN account.

26. Can I contribute in Tier I account once SLW has been opted ?

No additional Contribution is allowed in Tier I if SLW has been opted.

27. Can I open another PRAN account and initiate contribution in the new account and also continue previous PRAN where SLW has been opted ?

While the current SLW is still operational, you will not be able to open a new PRAN account. Subscriber can open another PRAN account and initiate contribution in the new account before the age of 70 years, provided the existing PRAN in which SLW option has been exercised is cancelled and closed and the entire balance lumpsum corpus is withdrawn and regular pension income from Annuity Service Provider has commenced.

28. What will happen to the remaining corpus in case of unfortunate death of Subscriber ?

In case of unfortunate death of the Subscriber during the SLW, his/her associated Nodal Office/POP/ NPST will have to initiate Death withdrawal request wherein entire corpus will be paid to the nominee. If annuity is not withdrawn, then Nominee/legal heir will have to mandatorily opt for Annuity withdrawal in case of Govt. Sector Subscriber and annuity will be optional in case of Non-Govt. Subscriber as per exit guidelines.

29. Can we open an NPS Tier II account without Tier I?

The NPS Tier II is a voluntary account that can be opened only if you have a Tier I account. When opening an NPS Tier II account, you are required to make a minimum contribution of Rs 1,000.

An additional deduction for investment up to Rs. 50,000 in NPS (Tier I account) is available exclusively to NPS subscribers under subsection 80CCD (1B). This is over and above the deduction of Rs. 1.5 lakh available under section 80C of Income Tax Act.

NPS Tier 2 accounts offer flexibility, tax benefits, and accessibility. However, limitations, including no pension payouts, tax implications, and investment restrictions, pose challenges.

30. What other facilities are available on the eNPS portal?

The subscribers who have been registered under NPS, can use the eNPS portal to login and make the following changes:

1. Change in Scheme Preference

2. Update Address (using Aadhaar number)

3. Update email ID/mobile number

4. View Account Details/Account Statement

5. Reset of I-PIN.

31. When will the units be credited to my NPS account?

Units will be credited to the subscriber’s account on the day contribution is invested by the PFM (Pension Fund Manager). It takes T+2 days to get unit credited in subscriber account, wherein T being the date of fund receipt at Trustee bank. This activity is called settlement in CRA system wherein, contribution is transferred from POP to PFM for investment in predefined scheme of subscriber and accordingly, the PFM declares NAV of the day and Units are allotted to the subscriber.

For example- POP who as an interface for the subscriber in NPS, collects NPS contribution from subscriber and uploads the contribution details in the CRA system and at the same time deposits the contribution to Trustee Bank (Bank designated for collection of NPS contribution from NPS intermediaries such as POP). The Trustee Bank, on receipt of contribution, uploads the contribution receipt details on CRA system. On receipt of these two information (contribution details from POP and contribution receipt information from Trustee Bank), the settlement process is initiated in the CRA system.

32. Can a Subscriber make contributions in his / her NPS account before receipt of the PRAN Card?

Yes. To contribute in NPS, only Permanent Retirement Account Number is required. Once PRAN is allotted to a Subscriber, contribution can be made irrespective of whether PRAN card is received or not.

33. What are the reasons for availing Partial Withdrawal?

Withdrawal is allowed only against the specified reasons such as,

A. Higher education of children

B. Marriage of children

C. For the purchase/construction of residential house.

D. For treatment of specified illnesses for Subscriber, Spouse, children.

E. To meet medical and incidental expenses arising out of the disability or incapacitation suffered by the Subscriber

F. For Skill development/re-skilling or any other self-development activities

G. For Establishment of own venture or any start-up (Only for ’All Citizens’ Sector Subscribers).

34. What will be the investment proof to avail the tax benefit under NPS?

The Subscriber can submit the Transaction Statement as an investment proof. Alternatively, Subscriber from "All Citizens of India" can also download the receipt of voluntary contribution made in Tier I account for the required financial year from NPS account log-in. It can be downloaded from the sub menu "Statement of Voluntary Contribution under National Pension System (NPS)" available under main menu "View" in NPS account log-in.

35. What are other tax benefits under NPS apart from available u/s 80CCD?

Apart from tax benefits available under 80CCD, below are the other tax benefits available under NPS:

Tax benefits on partial withdrawal:

Subscriber can partially withdraw from NPS Tier I account for specified purposes. Amount received from partial withdrawal are tax exempt u/s 10 (12B) of Income Tax Act.

Tax benefit on Annuity purchase:

Amount invested in purchase of Annuity, is fully exempt from tax. However, annuity income that you receive in the subsequent years will be subject to income tax.

Tax benefit on lump sum withdrawal:

Upto 60% of the total corpus withdrawn in lump sum is exempt from tax.

For example: If total corpus at exit is 10 lakhs, then 60% of the total corpus i.e. 6 lakhs, you can withdraw without paying any tax. So, if you use 60% of NPS corpus for lump sum withdrawal and remaining 40% for annuity purchase, you do not pay any tax at that time. Only the annuity income that you receive in the subsequent years will be subject to income tax as per the applicable tax slab.

36. What are the tax benefits on investments under Tier II account?

There is no tax benefit on investment towards Tier II NPS Account.

37. What happens to my corporate NPS if I quit my job?

You can shift the NPS account to new employer with same PRAN account if the new employer is already a registered entity under NPS. But if not, then you can continue the PRAN account under All Citizen Model (personal NPS).

38. Where shall Subscriber/Point of Presence (POP) find the Exit forms? What are the different types of Exit Forms?

You can find the Exit forms under "Forms" section, which is available under All Citizens of India/Corporate sector on this website. Based on the different types of Exit request, following forms are made available:

- Superannuation Exit

- Premature Exit

- Exit upon Death

- Continuation / Deferment of NPS

39. Is NPS better than PPF?

NPS may be better for those seeking higher returns and willing to take moderate risks, as it invests in equities and debt. PPF is ideal for risk-averse individuals preferring a fixed return. The choice depends on your risk tolerance and financial goals.

40. Which is better, NPS or SIP?

The choice of NPS vs SIP depends on your financial goals, risk tolerance and investment horizon. SIP may be a better choice if you prioritise flexibility and liquidity. NPS may be better for you if you want to set up a source of regular income for your post-retirement life

MORE ON NPS

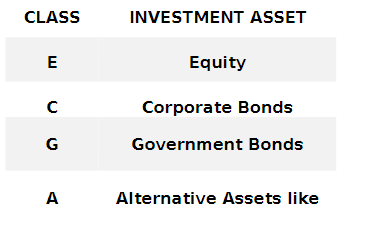

The National Pension System has four asset classes:

Returns/Interest

A portion of the NPS goes to equities (this may not offer guaranteed returns). However, it offers returns that are much higher than other traditional tax-saving investments like the PPF. This scheme has been in effect for over a decade, and so far, has delivered 9% to 12% annualised returns. In NPS, you are also allowed the option to change your fund manager if you are not happy with the performance of the fund.

Risk Assessment

Currently, there is a cap in the range of 50% to 75% on equity exposure for the National Pension Scheme. For government employees, this cap is 50%. In the range prescribed, the equity portion will reduce by 2.5% each year beginning from the year in which the investor turns 50 years of age.

However, for an investor of the age 60 years and above, the cap is fixed at 50%. This stabilizes the risk-return equation in the interest of investors, which means the corpus is somewhat safe from the equity market volatility. The earning potential of NPS is higher as compared to other fixed-income schemes.

Regulated

The PFRDA regulates NPS with transparent investment norms, regular performance reviews, and monitoring of fund managers by NPS Trust.

Flexibility

The NPS subscription is flexible. NPS subscribers can contribute to the NPS fund at any time in a financial year and change the number of subscriptions. They can choose their own investment options. They can operate their account online from anywhere and continue it even when they change their city and employment.

NATIONAL PENSION SYSTEM/SCHEME- TAX BENEFITS

Employee Tax Benefits For Self-Contribution:

Employees who contribute to NPS can claim the following tax benefits on their contributions:

Tax deduction of up to 10% of pay (Basic + DA) under Section 80CCD(1), subject to a maximum of Rs.1.5 lakh under Section 80CCE.

Tax deduction of up to Rs.50,000 under Section 80CCD(1B), along with the overall limit of Rs.1.5 lakh under Section 80CCE.

Employee Tax Benefits On Employer Contributions:

Employer's contribution towards NPS of an employee is eligible for a tax deduction of up to 10% of salary, i.e. basic plus DA, or 14% of salary if such contribution is made by the Central Government under Section 80CCD(2) beyond the Rs.1.5 lakh limit provided under Section 80CCE.

Tax Benefits For Self-employed People:

Self-employed individuals who contribute to NPS can claim the following tax benefits on their own contributions:

Tax deduction of up to 20% of gross income under Section 80CCD(1), subject to a total limit of Rs.1.5 lakh under Section 80CCE.

Tax deduction of up to Rs.50,000 under Section 80CCD(1B), along with the overall limit of Rs.1.5 lakh under Section 80CCE.

Tax Benefits On Partial Withdrawal From NPS Account:

Partial withdrawals from NPS are eligible for tax exemption when the amount withdrawn is up to 25% of self-contribution, subject to the circumstances and criteria prescribed by PFRDA under section 10(12B).

Tax Benefit On Annuity Purchase:

Tax exemption is provided on annuity purchase or superannuation at 60 years under Section 80CCD(5). However, the subsequent income from an annuity is taxed under Section 80CCD(3).

Tax Advantages On Lump Sum Withdrawal:

Section 10 provides a tax exemption on a lump sum withdrawal of 60% of accrued NPS funds upon reaching 60 years or superannuation.

Corporate/employer Tax Breaks:

A tax deduction is provided on the amount contributed to an employee's NPS account as an employer contribution, up to 10% of the employee's salary (Basic + DA) of the employer's contribution as a 'Business Cost' from the Profit & Loss Account under section 36(1)(iv)(a).

National Pension Scheme Early Withdrawal Or Exit Rules

Upon Superannuation - When a subscriber reaches the age of Superannuation/reaches the age of 60, he or she must use at least 40% of the accrued pension corpus to purchase an annuity that provides a regular monthly pension. The remaining monies are available for withdrawal as a lump payment.

Subscribers can take a 100% lump sum withdrawal if their entire accrued pension corpus is less than or equivalent to Rs.5 lakh.

Pre-mature Exit –

In the event of a premature exit (before reaching the age of superannuation/turning 60), at least 80% of the Subscriber's accrued pension corpus must be used to purchase an Annuity that provides a regular monthly income. If the total corpus is less than or equal to Rs.2.5 lakh, the subscriber can opt for 100% lumpsum withdrawal.

Upon the death of the subscriber - Following the subscriber's death, the entire accrued pension corpus (100%) would be paid to the subscriber's nominee/legal heir.

Equity Allocation Rules

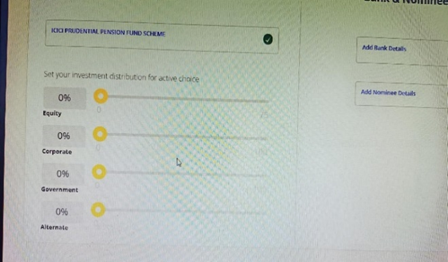

The NPS invests in different schemes, and the Scheme E of the NPS invests in equity. You can allocate a maximum of 50% of your investment to equities via– auto choice or active choice.

The auto choice decides the risk profile of your investments as per your age. For instance, the older you are, the more stable and less risky your investments. The active choice allows you to decide on the scheme and to split your investments.

Option to Change the Scheme or Fund Manager

With NPS, you have the provision to change the pension scheme or the fund manager if you are not happy with their performance(both tiers I and II accounts).

TYPES OF NPS ACCOUNTS

Annuity Plan

An annuity in the National Pension System (NPS) is an investment option. Upon reaching the age of 60, NPS subscribers can use a portion of their accumulated corpus to purchase an annuity from an insurance company. The annuity serves as a stable source of income, offering financial security in post-retirement life.

SYSTEMATIC LUMPSUM WITHDRAWAL(SLW):

Systematic lumpsum withdrawal is a facility under NPS wherein, upon superannuation exit, the lumpsum corpus can be withdrawn in a phased manner. Subscriber has the option to withdraw the desired amount systematically at regular periodic intervals. i.e, monthly, quarterly, half-yearly or yearly.

Benefits of Opting SLW as Compared to One-Time Lumpsum Withdrawal

With the SLW facility, the Subscriber will get the following benefits:

- It will help the Subscriber to generate regular cash flows.

- Along with Annuity, the regular cash flows through SLW will lead to an increase in the Subscriber's monthly income.

- SLW is a tool for additional Wealth Creation as returns shall continue to accumulate on the remainder Corpus which remains invested under NPS.

- Superannuation Age (in the context of NPS)- When a person reaches 60 yrs. Then he can withdraw 60% lumpsum amount from their NPS investment, the remaining 40% should be used to buy an annuity plan.

NPS Tier, I Lock-in Period

The NPS Tier I account has a lock-in till the age of 60. However, you can exit the system prematurely before 60 once you have completed 5 years. In case you choose this option, you will be able to withdraw only 20% of your accumulated corpus which will be exempt from tax. The balance 80% has to be used to buy annuity (regular pension). The annuity will be fully taxable as per the tax slab you fall into.

However, if the total NPS corpus is less than Rs. 2.5 Lakh then the complete corpus (100%) can be withdrawn as lump sum and this withdrawal will be exempt from tax.

MORE ON TIER 2 NPS ACCOUNTS

Tier 2 NPS is a voluntary account which you can open if you have already opened a Tier 1 Account. The account of NPS Tier 2 allows you the flexibility of withdrawals or investments into the scheme.

You can withdraw from your NPS Tier 2 investments as and when required without any limits. Moreover, no exit load is charged when you withdraw funds from your account of Tier 2 NPS.

NPS Tier 2 Benefits

You don’t have to pay any additional annual maintenance charge.

You can use the account to fund your emergency expenses or day to day expenses because the account allows easy and flexible withdrawals without any exit load.

You can choose to transfer amount from NPS Tier 2 to Tier 1 account when required.

There is no requirement to maintain a minimum balance in NPS Tier 2 Account.

You can nominate an individual to receive the account proceeds in case of your death.

You can invest in NPS Tier 2 in the same manner as you do in NPS Tier 1 account. Many investors opt to open a Tier 2 NPS Account because of the benefits which the account gives. Here’s a look at the main NPS Tier 2 benefits –

Eligibility criteria:

You should be Resident Indian , aged-18 to 70 years.

You should have a Tier 1 account and a PRAN number.

Minimum deposit amount while opening- 1000 rupees. Thereafter, your contributions to the account must be in the multiples of ₹250 per financial year to keep the account active.

You can open a Tier 2 account online or offline.

P.S. For an offline application, you should visit your bank’s branch and apply for the opening of the account.

Download NPS Mobile App and contribute anytime and anywhere on the go For Android and IOS us

FAQ ON FINAL EXIT, ANNUITY, AND CONTINUATION/ DEFERMENT PROCESS:

1. What is an Exit?

An exit is defined as closure of individual pension account of the Subscriber under National Pension System (NPS).

2. When can a Subscriber exit from NPS? What are the exit types under NPS?

As per PFRDA (Exits & Withdrawals under NPS) Regulations 2015 & amendments thereto, following Exit categories are allowed for the Subscribers who have joined NPS before attaining the age of sixty years:

Upon Normal Superannuation –

When a Subscriber reaches the age of Superannuation/attaining 60 years of age, at least 40% of the accumulated pension wealth of the Subscriber needs to be utilized for purchase of an Annuity providing for a regular pension to the Subscriber and the balance pension wealth is paid as lump sum to the Subscriber.

In case, the total corpus in the NPS account is less than or equal to Rs. 5 lakh, Subscriber can avail the option of complete (100%) Withdrawal.

Pre-mature Exit –

In case of pre-mature exit (exit before attaining the age of superannuation/attaining 60 years of age) from NPS, at least 80% of the accumulated pension wealth of the Subscriber needs to be utilized for purchase of an Annuity providing for a regular pension to the Subscriber and the balance pension wealth is paid as a lump sum to the Subscriber. However, Subscribers under All Citizens of India sector can exit from NPS only after completion of 5 years in NPS.

In case the total corpus in the NPS account is less than or equal to Rs. 2.5 lakh, the Subscriber can avail the option of complete (100%) Withdrawal.

Exit upon Death –

In case of death of Subscriber, the entire accumulated pension wealth of the Subscriber (100% NPS Corpus) shall be paid to the Nominees or Legal heirs, as the case may be, of such Subscriber. Though, the Nominee/Legal heir of the deceased Subscriber shall have the option to purchase any of the annuities being offered upon exit, if they so desire, while applying for withdrawal of benefits on account of deceased Subscribers’ Permanent Retirement Account. If nominee/legal heir wishes to opt for annuity (pension), they are required to select Annuity Service Provider (ASP) and annuity Scheme in Death Exit Form.

3. What are the exit types under NPS for a Subscriber, joining NPS on or after attaining the age of sixty years?

As per PFRDA (Exits & Withdrawals under NPS) Regulations 2015 & amendments thereto, following Exit categories are allowed for the Subscribers who have joined NPS on or after attaining the age of sixty years:

Upon Normal Superannuation (Exit after completion of three years in NPS)

– When a Subscriber exits after completion of three years in NPS, at least 40% of the accumulated pension wealth of the Subscriber needs to be utilized for purchase of an Annuity providing for a regular pension to the Subscriber and the balance pension wealth is paid as lump sum to the Subscriber.

In case, the total corpus in the NPS account is less than or equal to Rs. 5 lakhs, Subscriber can avail the option of complete (100%) Withdrawal.

4. Which options are available to Subscriber at the time of Superannuation / at the age of 60 years?

Subscriber can remain invested in NPS (Up to 75 years) or can exit from NPS. Following options are available to Subscribers:

Continuation of NPS Account:

Subscriber can continue to contribute to NPS account beyond superannuation/60 years (Up to 75 years) and avail additional tax benefit on the contributions. Subscriber has an option to exit anytime during continuation, if he/she wishes to exit.

Deferment of NPS Account:

Subscriber can defer his/her Withdrawal and stay invested in NPS up to 75 years of age. Subscriber can defer only lump sum Withdrawal, defer only Annuity or defer both lump sum as well as Annuity. Subscriber has an option to withdraw deferred lump sum amount in a phased manner up to 75 years of age or withdraw anytime the entire amount. Also, Subscriber has an option to exit anytime during Deferment, if he/she wishes to exit.

Continuation/Deferment option shall be exercised at least fifteen days prior to the age of 60 years/superannuation. Else, the NPS Account automatically continued till 75 years of age (as per PFRDA Exit Regulations) and there is no need to initiate separate continuation request. Subscriber has an option to exit anytime during continuation, if h However, Under Corporate sector, after 90 days of superannuation, if Subscriber doesn’t opt for Deferment/Continuation or Exit, account will get auto shifted to All Citizens of India Sector under mapped POP and continued under NPS till 75 years of age (as per PFRDA regulations). Subscriber has an option to exit anytime during continuation, if he/she wishes to exit.

CONCLUSION:

The National Pension System (NPS) offers a comprehensive framework for retirement planning, providing flexibility and various options for subscribers. While NPS subscribers cannot avail loans against their accounts, they can opt for partial withdrawals under specific conditions, such as higher education or marriage of children, purchasing a house, or medical treatment. Additionally, the NPS offers several tax benefits, making it an attractive option for retirement savings. Subscribers can also choose from various annuity plans to suit their retirement needs.

Upon reaching the age of superannuation (60 years), subscribers are required to use at least 40% of their accrued pension corpus to purchase an annuity, ensuring a steady monthly pension. The remaining amount can be withdrawn as a lump sum, with an exception allowing a full withdrawal if the total corpus is less than Rs. 5 lakh.

For those exiting the scheme prematurely, before the age of 60, at least 80% of the corpus must be used to buy an annuity. However, a full lump sum withdrawal is permitted if the total corpus is Rs. 2.5 lakh or less. In the unfortunate event of a subscriber's death, the entire corpus is paid to the nominee or legal heir.

The NPS also provides an investment choice between equity and other asset classes, with a maximum equity allocation of 75%. In aggressive life cycle fund, maximum equity allocation is 75 percent, it reduces to 50 per cent in case of moderate life cycle fund and in case of conservative life cycle fund, the equity allocation is 25 percent. Subscribers can opt for auto or active choice to manage their risk and investment strategy. The scheme offers two types of accounts: Tier-I (default and tax-advantaged) and Tier-II (voluntary with flexible withdrawals).

Moreover, subscribers have the flexibility to change their pension scheme or fund manager, and they can opt for Systematic Lumpsum Withdrawal (SLW) upon retirement.

Overall, the NPS serves as a robust framework for ensuring financial security in retirement, offering both stability through annuities and the potential for growth through continued investment.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts